GCCs in India: Powering the Next Phase of Office Space Growth

India’s office market has been buzzing with activity, and one big reason behind this momentum is the rise of Global Capability Centers (GCCs). These centers, set up by multinational companies, are no longer just back-end offices. Instead, they are evolving into innovation hubs, driving research, product development, and digital transformation for global enterprises.

According to the latest report by Colliers India, GCCs have leased close to 100 million square feet of office space across the top seven cities since 2021. Let’s explore what’s fueling this demand and what lies ahead.

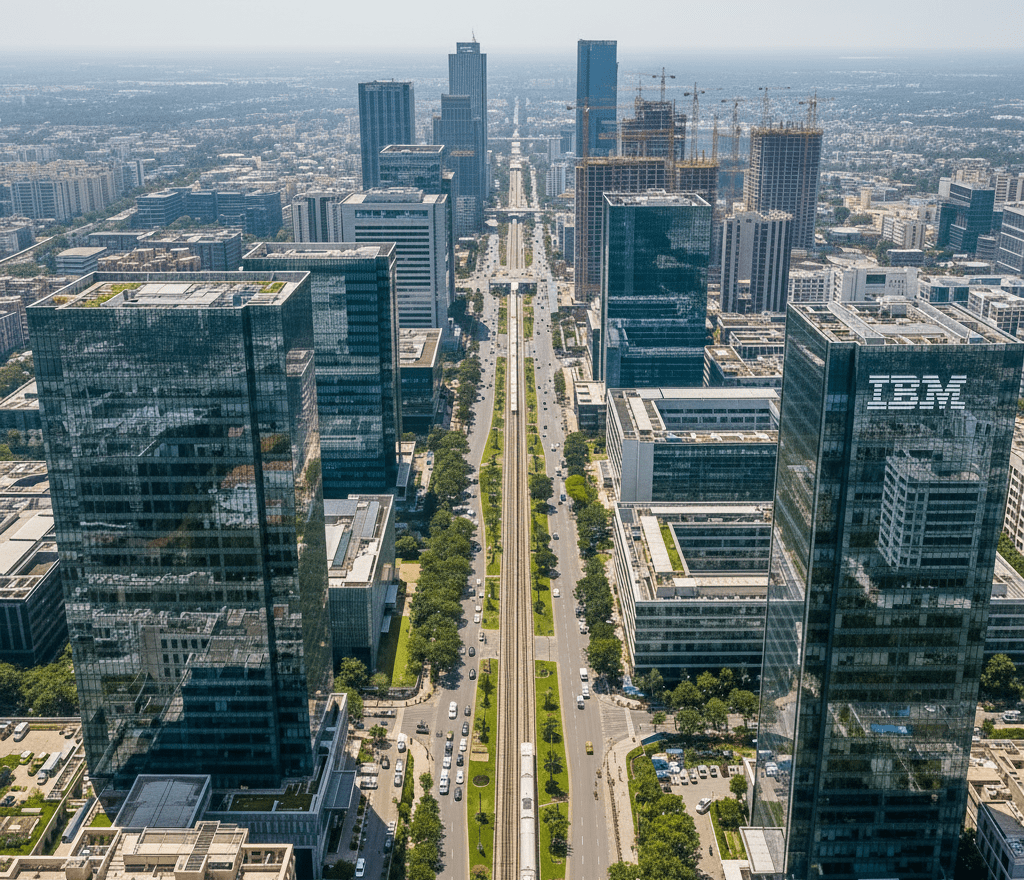

🏢 Bengaluru and Hyderabad: The GCCs Powerhouses

When it comes to GCC expansion, Bengaluru and Hyderabad are leading the charge. Together, these cities have accounted for over 60% of GCC leasing since 2021. Bengaluru remains the first choice for tech-driven GCCs as well as engineering and manufacturing firms. Hyderabad, on the other hand, attracts companies with its modern infrastructure, strong talent pool, and competitive rentals.

Interestingly, Chennai is emerging as a dark horse. The city has recorded a 5.3X surge in GCC leasing from 2021 to 2025, thanks to affordable rentals in peripheral areas. This trend highlights how cost-sensitive firms are diversifying beyond traditional hubs.

📈 Demand Outlook: A Strong Growth Trajectory

GCC demand is not slowing down. In fact, leasing activity is expected to touch 28 million square feet in 2025, almost double the 2021 levels. Looking further, GCCs are likely to lease 60–65 million square feet between 2026 and 2027, reflecting a solid growth of 15–20% compared to the previous two years.

This surge means one thing: GCCs will continue to remain the cornerstone of India’s office market. Their role is no longer limited to cost efficiency but also includes value creation, innovation, and strategic expansion.

💼 Sector Shift: BFSI and Engineering on the Rise

While the technology sector still leads with 37% of GCC leasing, its demand has stabilized. The spotlight is now shifting toward Banking, Financial Services, and Insurance (BFSI) along with engineering and manufacturing.

- BFSI’s share of GCC demand grew from 15% in 2021 to 27% in 2025, driven by digital banking, fintech, compliance, and risk management.

- Engineering and manufacturing GCCs also increased their share from 11% to 17% in the same period.

Together, these two sectors are expected to drive 40–50% of future GCC space uptake, showcasing India’s transition from a tech-heavy market to a diversified one.

🏗️ Flex Spaces and Tier II Cities: The New Frontiers

Another interesting trend is the rising popularity of flex spaces. GCCs now prefer scalable and agile workplaces that allow them to adapt quickly. This shift is boosting demand for Grade A flexible workspaces across India’s top cities.

At the same time, Tier II cities are gaining momentum. Cost arbitrage, improving infrastructure, and abundant talent pools make them attractive for GCC expansions. This decentralization ensures that growth spreads beyond traditional hubs.

🚀 The Road Ahead for GCCs in India

The journey of GCCs in India tells a powerful story. From being back-office support centers, they have transformed into innovation-driven, domain-specialized, and technology-integrated hubs. They now drive more than 40% of India’s total office space demand, and this number will only grow in the coming years.

As global enterprises continue to rely on India for talent and innovation, the country’s office real estate market is set for sustained growth. With Bengaluru, Hyderabad, and Chennai leading the way, and Tier II cities catching up, India is cementing its position as the global GCC capital.

✅ Final Takeaway:

GCCs are no longer just about saving costs. They are about building the future of global enterprises and India stands at the center of this transformation.